Dental Of America

- Family Dental Insurance

The American dental insurance plans are

based upon the zip code and their availability. If we are

unable to offer a dental insurance plan, we will provide a alternative dental plan, if available, and clearly state it.

Please be sure to

contact the plan dental office to confirm they are accepting new

patients and they are accepting the dental plan you have selected.

If

you have any dental insurance plan questions please feel free to

contact our office during regular business

hours. You will find our licensed insurance agents ready to assist you.

Extension of eligibility may be

made up to the age of 23 years for unmarried children who are principally

dependent upon the subscriber and are registered students in regular, full-time

attendance at an accredited school, college, or university (subscriber will be

required to submit evidence of full-time status).

There

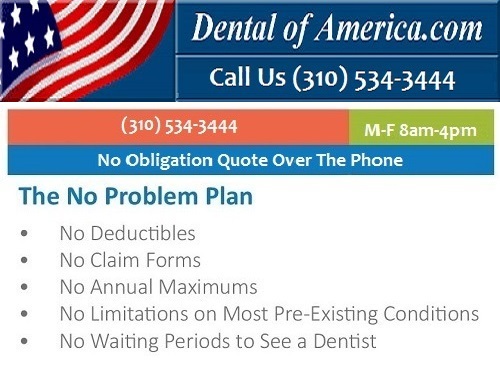

are no deductibles and no yearly limits on services, and there are no claim

forms to fill out. The dentists must meet the Plan's standard of quality and

service. All have agreed to provide dental care at a low cost available only to

its members. There is no waiting period for your dental services to begin,

pre-existing dental conditions are covered. A reminder your application must be

received by the company on or before the last day of the month prior to the

following month's coverage effective date.

There

are no deductibles and no yearly limits on services, and there are no claim

forms to fill out. The dentists must meet the Plan's standard of quality and

service. All have agreed to provide dental care at a low cost available only to

its members. There is no waiting period for your dental services to begin,

pre-existing dental conditions are covered. A reminder your application must be

received by the company on or before the last day of the month prior to the

following month's coverage effective date.

An Enrollment Application is a request for coverage, which, if approved by

California Dental Network, becomes the enrollment form used to issue an

identification card and Combined Evidence of Coverage and Disclosure Form. All

benefits, limitations and exclusions are stated in full in the Combined Evidence

of Coverage and Disclosure Form which is provided

when

coverage becomes effective. Members will have 30 days from receipt of the

Combined Evidence of Coverage and Disclosure Form to cancel their enrollment and

receive a full refund of their premiums if they have not utilized the Plan. You

may obtain a copy of the Combined Evidence of Coverage and Disclosure Form from

their Corporate Office before you enroll.

when

coverage becomes effective. Members will have 30 days from receipt of the

Combined Evidence of Coverage and Disclosure Form to cancel their enrollment and

receive a full refund of their premiums if they have not utilized the Plan. You

may obtain a copy of the Combined Evidence of Coverage and Disclosure Form from

their Corporate Office before you enroll.

Limitations (1) Prophylaxis (cleaning) is limited to once every six months. (2)

Fluoride treatment is covered once every 12 months for Members up to age 14. (3)

Bitewing x-rays are limited to one series of four films every 12 months. (4)

Full mouth x-rays are limited to once every 24 months. (5) Sealants are covered

for Members up to the age of 14 and are limited to permanent first and second

molars. (6) Periodontal treatments (subgingival curettage and root planning)

are

limited to one treatment per quadrant in any 12-month period. (7) Fixed

bridgework will be covered only when a partial cannot satisfactorily restore the

case.(8) Replacement of partial dentures is limited to once every five years.

(9) Full upper and/or lower dentures are not to exceed one each in any five-year

period. (10) Denture relines are limited to one per arch in any 12-month period.

are

limited to one treatment per quadrant in any 12-month period. (7) Fixed

bridgework will be covered only when a partial cannot satisfactorily restore the

case.(8) Replacement of partial dentures is limited to once every five years.

(9) Full upper and/or lower dentures are not to exceed one each in any five-year

period. (10) Denture relines are limited to one per arch in any 12-month period.

Exclusions (1) General anesthesia, analgesia (nitrous oxide), intravenous

sedation, or the services of an anesthesiologist. (2) Treatment of fractures or

dislocations; congenital malformations; malignancies, cysts, or neoplasms; or

Temporomandibular Joint Syndrome (TMJ). (3) Extractions or x-rays for

orthodontic purposes. (4) Prescription drugs and over the counter drugs. (5) Any

services involving implants or experimental procedures. (6) Any procedures

performed for cosmetic, elective or aesthetic purposes. (7) Any procedure to

replace or

stabilize

tooth structure lost by attrition, abrasion, erosion or grinding.

stabilize

tooth structure lost by attrition, abrasion, erosion or grinding.

Not all general dentists are

capable of performing each of the services listed herein and, based upon the

Memberís condition, certain procedures may not be within the scope of practice

or ability of a general dentist. In such cases, the general dentist will refer

the Member to a California

Dental Network participating dental specialist, who will give the Member a 30%

discount from their regular fees during the first year of enrollment, and a 50%

discount thereafter, for up to $1,000 in services per year. The ratio of premium

costs to health services paid, for plan contracts with individuals and groups of

25 or fewer members, during the preceding fiscal year was 0%. * UCR means the

dentistís or specialistís Usual, Customary & Reasonable fees. # Member is

responsible for the payment shown plus the actual lab cost of gold.

Orthodontists may charge Members additional fees for costs of cases over 24

months, based on the differences in UCR fees for the needed treatment periods

less the UCR fees for a 24-month treatment period.